|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

How to File Bankruptcy in Delaware: A Comprehensive Guide

Filing for bankruptcy in Delaware can be a complicated process, but it offers a fresh start for those overwhelmed by debt. Understanding the steps and requirements is crucial for a successful filing.

Understanding Bankruptcy Types

There are different types of bankruptcy available, each suited to various financial situations.

Chapter 7 Bankruptcy

Chapter 7 involves liquidating non-exempt assets to pay creditors. It is suitable for individuals with limited income.

Chapter 13 Bankruptcy

Chapter 13 allows individuals to reorganize their debts and create a repayment plan, typically over three to five years.

Steps to File for Bankruptcy

- Gather Financial Documents: Collect all necessary financial records, including income, expenses, debts, and assets.

- Credit Counseling: Attend a mandatory credit counseling session within 180 days before filing.

- File the Petition: Submit a bankruptcy petition along with supporting documents to the Delaware bankruptcy court.

- Automatic Stay: Once filed, an automatic stay is enacted, halting most collection activities.

- Meeting of Creditors: Attend the 341 meeting where creditors can ask questions about your financial situation.

If you need professional guidance, consider consulting with a bankruptcy attorney pittsburgh to ensure you meet all legal requirements.

Life After Bankruptcy

Filing for bankruptcy is not the end but a new beginning. It’s essential to manage finances wisely post-bankruptcy.

- Create a Budget: Develop a realistic budget to avoid future financial pitfalls.

- Build Credit: Gradually rebuild your credit by paying bills on time and using credit responsibly.

- Seek Financial Advice: Professional advice can help you stay on track and maintain financial health.

For personalized advice on managing life post-bankruptcy, consult with a bankruptcy attorney portland who can provide local expertise and support.

Frequently Asked Questions

What is the cost of filing bankruptcy in Delaware?

The filing fee for Chapter 7 is $338, while Chapter 13 costs $313. Additional costs may include attorney fees.

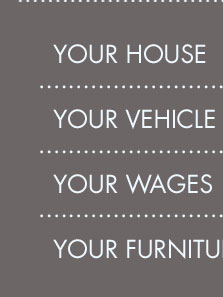

Can I keep my home and car after filing?

Yes, exemptions exist that may allow you to keep essential assets like your home and car, especially under Chapter 13.

How long does bankruptcy remain on my credit report?

Chapter 7 bankruptcy can remain on your credit report for up to 10 years, whereas Chapter 13 typically lasts for 7 years.

National forms, local forms, local forms are drafted and approved by the Board of Judges for use in the District of Delaware.

Delaware Bankruptcy Process How to File Bankruptcy in Delaware - 1) It must be delivered in good faith. - 2) Unsecured creditors must be paid at least as much ...

We created this guide to provide an overview of Delaware Chapter 7 bankruptcy proceedings for individuals, including how to file your case without an attorney.

![]()